Market Crest™

A multi-year guarantee indexed annuity with market-related upside

Market Crest™ is ideal for clients planning for retirement or seeking a safe and secure home for their investment. It combines the reliable growth of a fixed annuity, offering a guaranteed interest rate, with the opportunity for an interest bonus tied to the positive performance of the S&P 500® Index*, all while negating any downside risk.

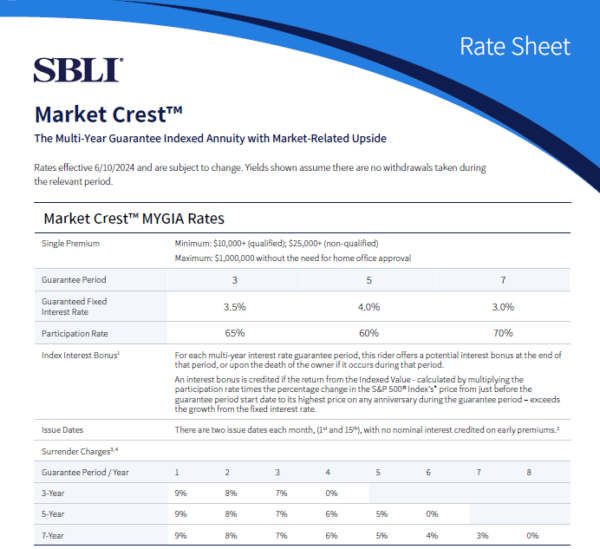

Market Crest™ Rates

3-Year

Guaranteed Fixed Interest Rate

3.5%

Participation Rate

65%

5-Year

Guaranteed Fixed Interest Rate

4.0%

Participation Rate

60%

7-Year

Guaranteed Fixed Interest Rate

3.0%

Participation Rate

70%

Rates effective 06/10/2024 and are subject to change. Yields shown assume there are no withdrawals taken during the relevant period.

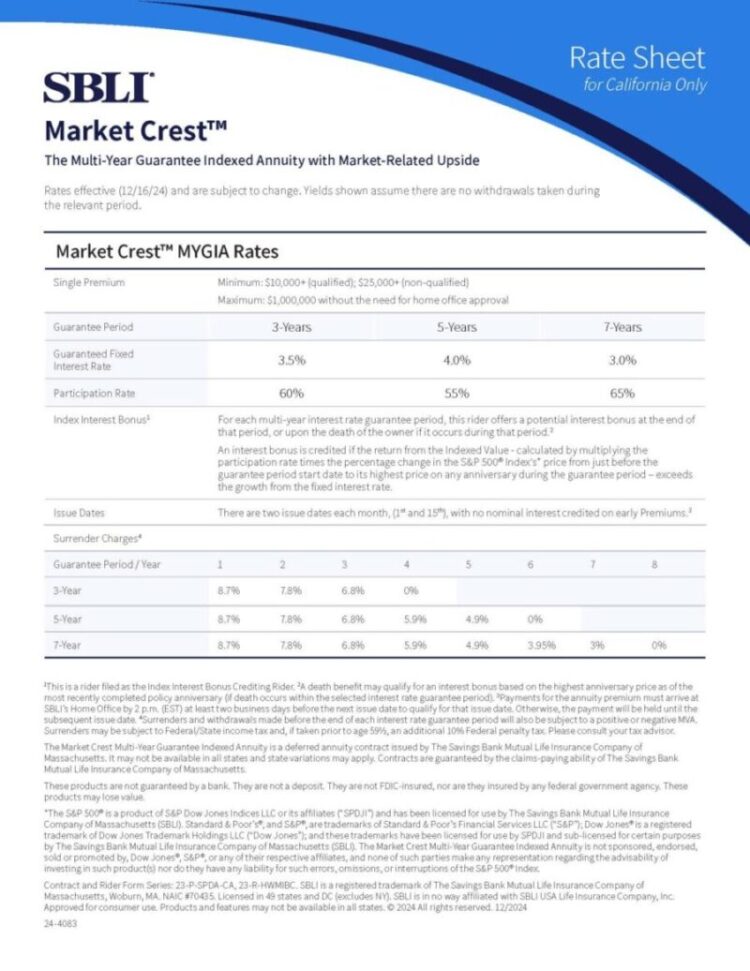

Please note California may have different guaranteed interest and/or participation rates, please review the Market Crest Rate Sheet for California for details.

KEY FEATURES

- Choice of Guarantee Periods

Select from 3-, 5-, or 7-year1 guarantee periods.

- Eligibility

- Single Premium

$10,000 (qualified) and $25,000 (non-qualified) minimums.

Up to $1,000,000 maximum (without home office approval).

- Guaranteed Interest Rates

Competitive rates guaranteed for the selected period.

- Issue Dates

There are two issue dates each month, (1st and 15th), with no nominal interest credited on early premiums.2

- Index Interest Bonus Crediting Rider

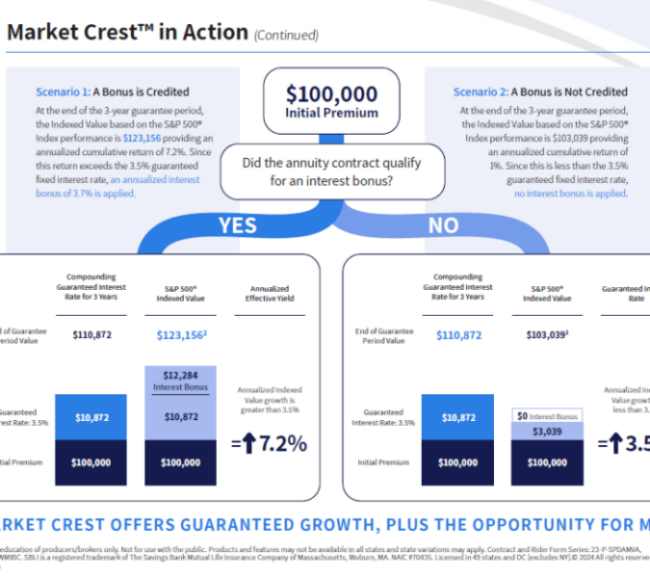

An interest bonus is awarded if the return from the Indexed Value based on the S&P 500® Index’s performance exceeds the total guaranteed interest growth at the end of the selected interest rate guarantee period.3

Depending on the selected guarantee period, clients have multiple chances to capture the high-water mark price, increasing the potential for enhanced returns while reducing the impact of unfavorable market conditions.

- Terminal Illness/Nursing Home Riders

Terminal Illness and Nursing Home riders are automatically included at no additional cost and provide financial relief under specific conditions.4

- Withdrawal Options⁵

IRS-mandated Required Minimum Distributions (RMDs) starting in the first contract year may be withdrawn without a penalty.

Annual withdrawals up to 5%6of the contract value, from year 1 onwards, are currently allowed without incurring Surrender Charges or MVA. Withdrawals that exceed this limit will be subject to these charges.

Please note, partial withdrawals (other than Required Minimum Distributions) during the selected interest rate guarantee period will render the contract ineligible for receiving the Index Interest Bonus at the end of that period and this rider will lapse. 7

-

Market Value Adjustment (MVA)

Not applicable in California

Applies to early surrenders or withdrawals greater than the free withdrawal percentage of the accumulated value, ensuring fair value adjustments.

- Renewal Options

For 30 calendar days after the end of the initial guarantee period, your clients can choose to move their money penalty-free to a guarantee period that does not exceed their original, begin annuity payouts, or withdraw some or all the annuity’s value.7

For a more detailed description of Market Crest’s features and benefits, please review the Market Crest Fact Sheet.

Choice of Guarantee Periods

Select from 3, 5, or 7-year guarantee periods.

Eligibility

Available for individuals aged 18 – 90 (non-qualified) and 18 – 85 (qualified).

Single Premium

$10,000 (qualified) and $25,000 (non-qualified) minimums.Up to $1,000,000 maximum (without home office approval).

Guaranteed Interest Rates

Competitive rates guaranteed for the selected period.

Index Interest Bonus Credit Rider

A bonus is awarded if the Indexed Value based on the S&P 500® Index’s performance surpasses the total guaranteed interest growth at the end of the selected interest rate guarantee period.¹

Terminal Illness/Nursing Home Waivers

Terminal Illness and Nursing Home Waiver riders are automatically included at no additional cost, and provide financial relief under specific condition.

Withdrawal Options

From year 1 onwards, partial withdrawals of up to 5% of the contract value are permitted without incurring Surrender Charges or a Market Value Adjustment (MVA). However, withdrawals exceeding this limit will be subject to these charges.²However, any partial withdrawals (other than RMDs) during the selected interest rate guarantee period will render the contract ineligible for receiving the Index Interest Bonus at the end of that period.

Renewal Options

Within the thirty days following the end of the guarantee period, one of the following may be selected without an MVA or withdrawal charge:

- A second multi-year interest rate guarantee period with the same or shorter guarantee period and index. Please note, this is the default option.

- Withdraw some or all of the annuity’s accumulated value.

- Begin annuity payouts.

For a more detailed description of Market Crest’s features and benefits, please review the Market Crest Agent Guide.

Product Resources

Found 15 Results

National Rate Sheet

View & DownloadCalifornia Rate Sheet

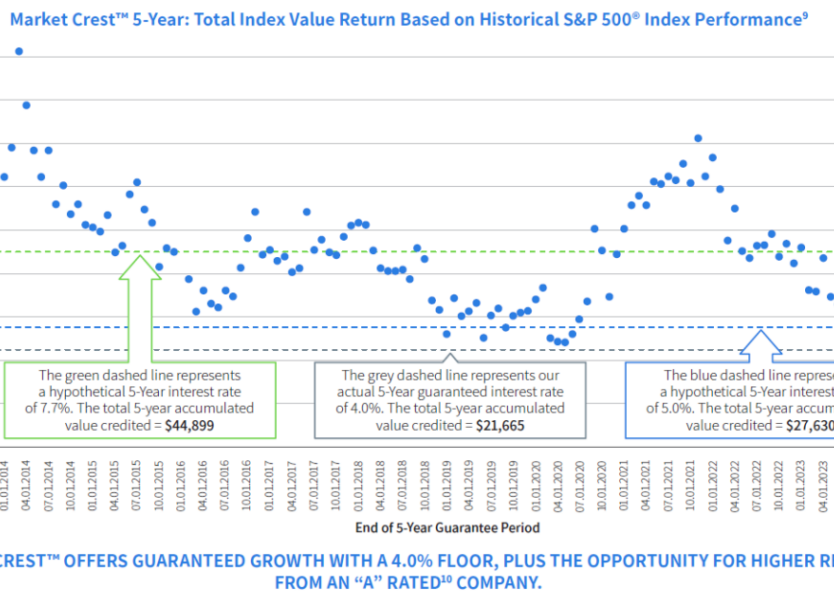

View & Download5-Year Guarantee Period Historical Performance Chart

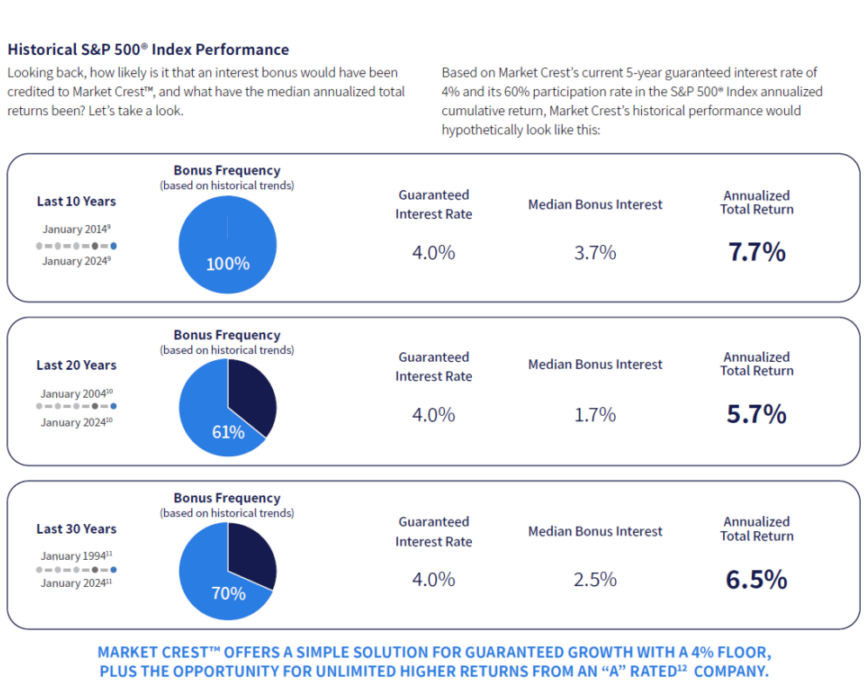

View & DownloadHistorical Performance Returns

View & DownloadFact Sheet

View & DownloadFinancial Strength

View & DownloadProduct Availability Map

View & Download3-Year Guarantee Period Agent Sales Sheet

View & DownloadConsumer Brochure

View & Download3-Year Guarantee Period Consumer Sales Sheet

View & Download7-Year Guarantee Period Consumer Sales Sheet

View & Download5-Year Guarantee Period Consumer Sales Sheet

View & DownloadKEY POINTS OF CONTACT

ACTIVITY

CONTACT INFORMATION

Onboarding

For any agency or agent onboarding questions

IAMS Sales Support Team

9am-6pm ET, M-F

Telephone #: 1-800-255-5055

Email: annuitymarketing@iamsinc.com

Sales Support

For sales and marketing support

IAMS Sales Support Team

9am-6pm ET, M-F

Telephone #: 1-800-255-5055

Email: annuitymarketing@iamsinc.com

Commissions

For commission questions

Commissions

8am – 5pm ET, M-F

Telephone #: 1-888-224-7254 (option 5)

Email: sblicommissions@sbli.com

Agent Sales Portal

For access to illustrations, your business summary, and commission statements

Telephone #:1-888-224-7254 (option 1)

Email: brokerage@sbli.com

¹Only the 3-year guarantee period is available in Ohio. 2Payments for the annuity premium must arrive at SBLI’s Home Office by 2 p.m. (EST) at least two business days before the next issue date to qualify for that issue date. Otherwise, the payment will be held until the subsequent issue date.3Please note, the bonus is calculated based on the terms of the Index Interest Bonus Crediting Rider as defined in the contract. 4Refer to the contract for further details. 5Withdrawals will reduce the contract value and other benefits under the contract. Withdrawals that exceed any free withdrawal amount during the surrender charge period will be subject to a surrender charge. All withdrawals are subject to ordinary income tax and, if taken prior to age 59 ½, may be subject to a 10% federal tax penalty. Please consult your tax advisor. 6The free annual withdrawal percentage in the Second Interest Rate Guarantee Period will be determined at the end of the Initial Interest Rate Guarantee Period. 7Any withdrawal in the interest guarantee period except for RMDs will terminate the rider with no future interest bonus payment

The Market Crest™ Multi-Year Guarantee Indexed Annuity is a deferred annuity contract issued by The Savings Bank Mutual Life Insurance Company of Massachusetts. It may not be available in all states and state variations may apply. Contracts are guaranteed by the claims paying ability of The Savings Bank Mutual Life Insurance Company of Massachusetts.

These products are not guaranteed by a bank. They are not a deposit. They are not FDIC insured, nor are they insured by any federal government agency. These products may lose value.

*The S&P 500® is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”) and has been licensed for use by The Savings Bank Mutual Life Insurance Company of Massachusetts (SBLI). Standard & Poor’s®, and S&P®, are trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by The Savings Bank Mutual Life Insurance Company of Massachusetts (SBLI). The Market Crest™ Multi-Year Guarantee Indexed Annuity is not sponsored, endorsed, sold or promoted by, Dow Jones, S&P, or any of their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for such errors, omissions, or interruptions of the S&P 500® Index.

For the education of producers/brokers only. Not for use with the public. Products and features may not be available in all states and state variations may apply. Contract Series: 23‐P‐SPDAMVA, Rider Form Series: 23-R-HWMIBC, BR-5, BR-2. SBLI is a registered trademark of The Savings Bank Mutual Life Insurance Company of Massachusetts, Woburn, MA. NAIC #70435. Licensed in 49 states and DC (excludes NY). © 2025 All rights reserved. 1/2025

24-4118